Commercial Property

As lending markets become more specialized and fragmented, securing the right capital structure for commercial property investment or development requires both sector-specific expertise and access to diverse funding sources.

Evercrest Partners delivers strategic debt solutions across all asset classes, including retail, industrial, office, and residential construction, ensuring financing is aligned with each stage of the development life cycle. From bridging and development finance to structured debt solutions such as mezzanine and stretch senior lending, we provide the insight and execution needed to optimize funding structures and drive successful outcomes.

Expertise Across Asset Classes

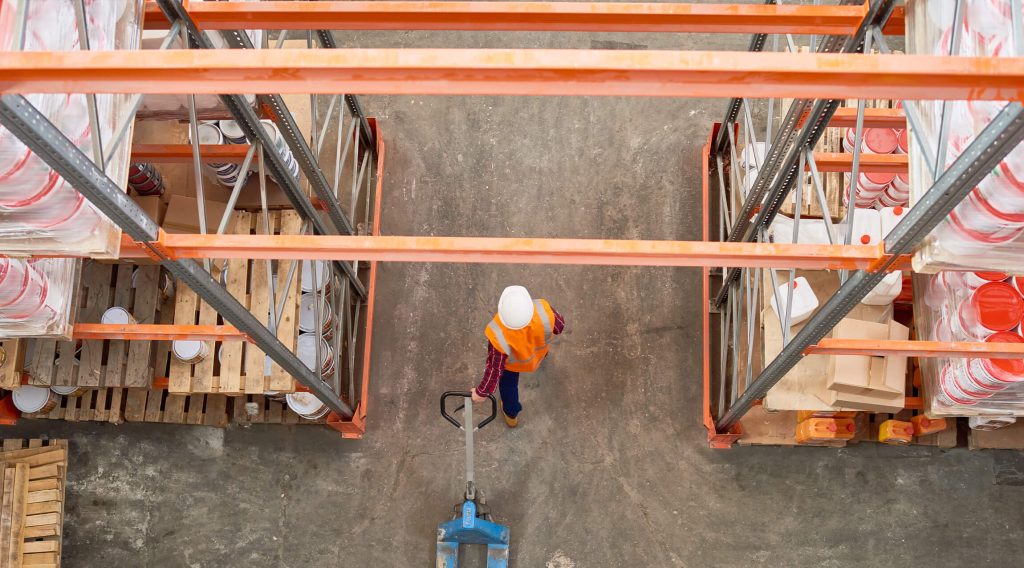

Comprehensive finance solutions for all CRE asset types including retail, commercial, industrial, as well as residential construction.

Development Lifecycle-Focused Advisory

Funding tailored to every stage of your development, from site and construction, to residual stock and other property development lifecycle solutions.

Capital Stack Support

Structured debt finance solutions including senior and stretch loans, mezzanine finance, and alternative CRE financing.